Why Diversify Your Income? The Core Benefits

As Robert Kiyosaki famously stated in "Rich Dad Poor Dad," "The rich don't work for money. They have money work for them." A significant part of having money "work for you" involves creating multiple avenues for income. The advantages of cultivating additional income streams extend far beyond simply having more money:

Chief Investment Strategist, Lunova

Exploring Types of Income Streams

Multiple income streams generally fall into two broad categories:

1. Passive Income:

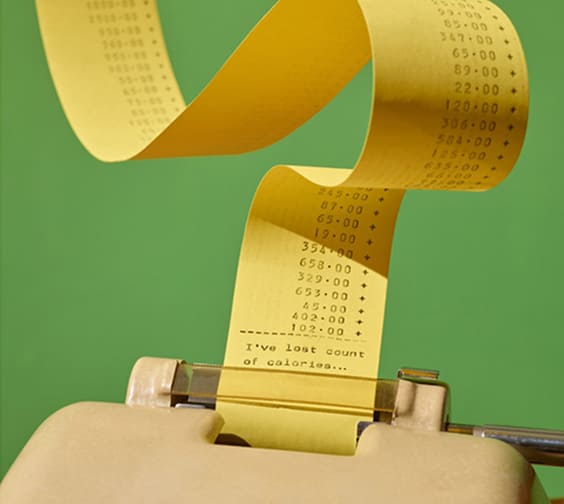

Often seen as the holy grail of financial freedom, passive income requires significant upfront effort or capital, but minimal ongoing work once established.

- Rental Properties: Investing in real estate that generates monthly rental income.

- Dividend Stocks & Bonds: Earning regular payments from investments in dividend-paying companies or interest from bonds.

- High-Yield Savings Accounts/CDs: Earning interest on your cash savings.

- Royalties: Income from creative works (books, music, patents) that continues as long as the work is used.

- Peer-to-Peer (P2P) Lending: Earning interest by lending money to individuals or small businesses through online platforms.

2. Active Side Hustles:

These require more active time and effort, but can provide more immediate cash flow and leverage existing skills. Offering your professional skills (e.g., writing, graphic design, marketing, coding) on a contract basis.

Financia's Role in Your Multi-Stream Journey

At Lunova, we understand that building multiple income streams is a strategic move, not just a casual pursuit. Our advisors can help you: Work with you to explore income-generating ideas that align with your skills, risk tolerance, and financial goals.